Alright, gather ’round, fellow shopaholic sleuths, because today’s mystery is straight out of the high-stakes aisle of Wall Street’s glitzy mall. Nvidia insiders — yep, those folks who basically hold the keys to the AI chip kingdom — have dumped over a billion bucks in stock this past year. Wait, a billion? Seriously? As your trusty consumer detective disguised as a budget-conscious mole in the secondhand aisles, I’m here to sniff out the meaning behind this mega sell-off. Spoiler alert: it’s not as simple as “They’re bailing, dude.”

The Case of the Billion-Dollar Stock Dump: Timing Is Everything

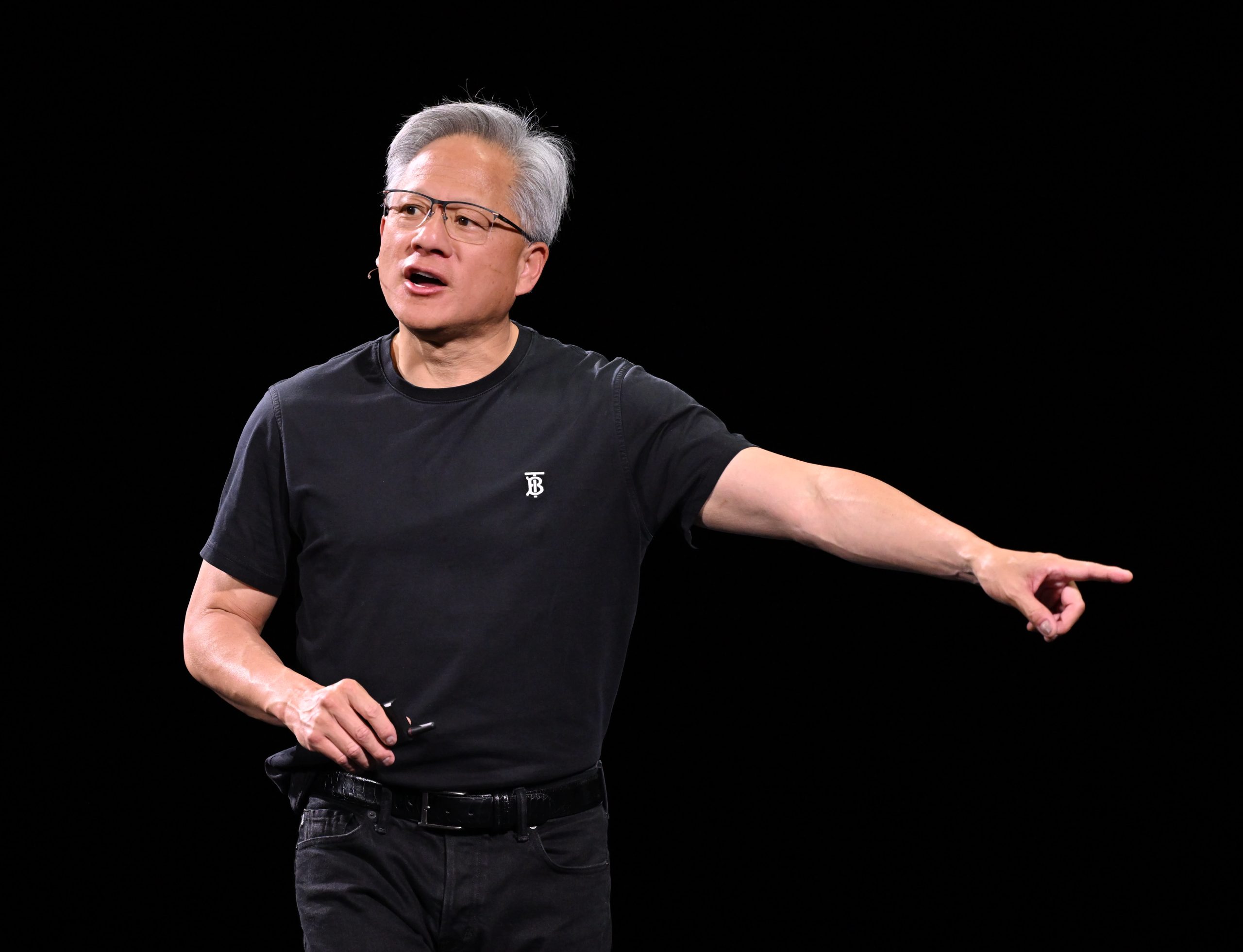

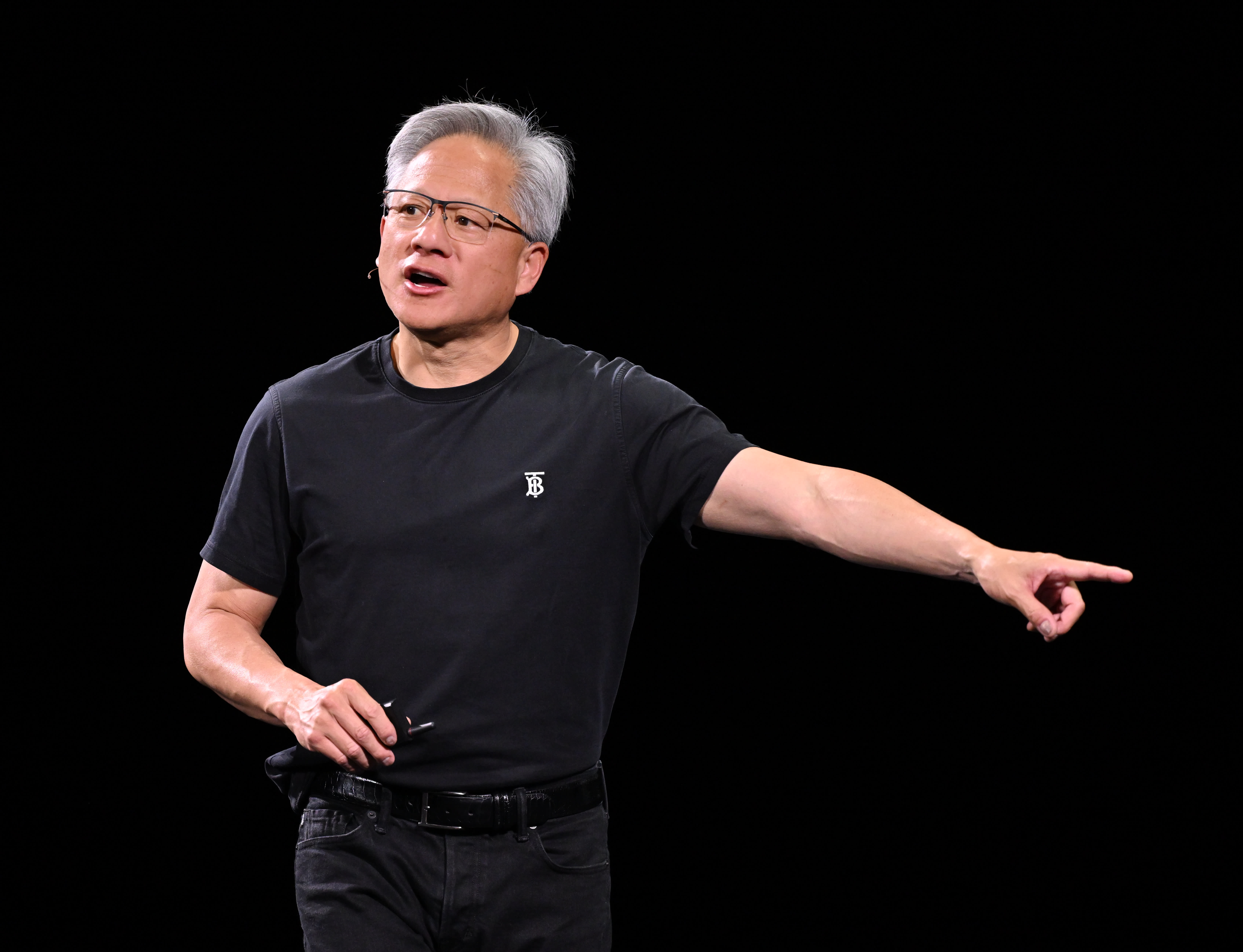

First clue: scale and timing. Our Nvidia insiders sold more than $10^9 worth of stock over the last 12 months — over half of that in June when Nvidia shares were shining like a neon sign at a midnight sale. Even Jensen Huang, Nvidia’s CEO and the head honcho who usually keeps his wallet zipped, finally decided to cash out last September and jumped into the selling frenzy this year. Now, if this happened at a sketchy hour or below anticipated prices, I’d say we’re dealing with insider doom and gloom. But no, this was during a historic price surge, with Nvidia’s market cap flexing bigger than Microsoft’s. It’s like selling your vintage kicks right after their value spikes — smart, not crazy.

High Stock Prices and Buybacks: The Perfect Storm for Cashing Out

Let’s talk motives. The AI explosion powered Nvidia’s stock to stratospheric levels. For insiders, that’s akin to finding a vintage Chanel bag at thrift price and then watching it become runway gold overnight — hello, quick asset flip! Selling at peak prices is a savvy move, not a panic retreat.

On top of that, Nvidia launched a $50 billion stock buyback plan. Think of buybacks like a store cleaning out unwanted inventory but, in this case, Nvidia’s scooping up its own shares to drive prices higher and toast shareholder value. Some of our insider sellers are probably just funding new adventures, or, you know, making sure their portfolios don’t look like someone who hoards clearance racks at every sale.

Cloudy Future or Just Smart Financial Planning?

Here’s where it gets juicy. The competitive AI chip market is heating up fast: AMD, Intel, even big bad tech giants are ramping up their own chips like rival streetwear brands chasing the latest hype. Nvidia’s lead might not be forever, and insiders might be hedging their bets in anticipation of a tougher battlefield. Plus, global economic turbulence and political drama add storm clouds to the horizon.

But here’s the clincher — Nvidia’s stock price didn’t tank after the insider sales news. Nope, it danced higher, hitting new peaks as if to say, “Bring it on!” Market confidence remains strong, confounding cynics sniffing out a selling-induced crash.

—

In a nutshell, Nvidia insiders unloading over a billion dollars’ worth of shares is like spotting a savvy shopper snagging and flipping hot merch during a flash sale. It’s a complex signal, blending financial smarts, market timing, and a dash of caution. Not necessarily a red flag waving from the discount rack, but a call for all of us investors to keep our eyes peeled, wallets guarded, and brains engaged. Because in the wild retail jungle of AI stocks, every dollar sold and bought tells a story — and this one’s just getting started. Keep those magnifying glasses handy, friends; the plot thickens.