The Semiconductor Gold Rush: How TSMC’s Record Sales Expose the AI Chip Frenzy

Dude, let’s talk about the elephant in the room—TSMC just dropped a bombshell with its April sales skyrocketing 48% year-over-year to NT$349.57 billion. Seriously, that’s not just a spike; it’s a full-blown eruption, and it’s all thanks to the AI chip craze. As a self-proclaimed spending sleuth, I’ve been digging into this like a bargain hunter at a sample sale, and here’s the tea: the semiconductor industry isn’t just growing; it’s morphing into a high-stakes game where AI is the only player that matters.

The AI Chip Boom: TSMC’s Cash Cow

First off, let’s decode why TSMC’s sales are blowing up faster than a viral TikTok trend. The answer? AI chips—specifically, the kind powering everything from ChatGPT to self-driving cars. TSMC, the world’s top contract chipmaker, isn’t just riding the wave; it’s the wave. Revenue didn’t just jump 48% from last April—it also climbed 22% from March, proving demand isn’t a fluke. Analysts predict AI-related server and processor sales could double by 2025, and TSMC’s Q2 forecast ($19.6B–$20.4B) screams confidence.

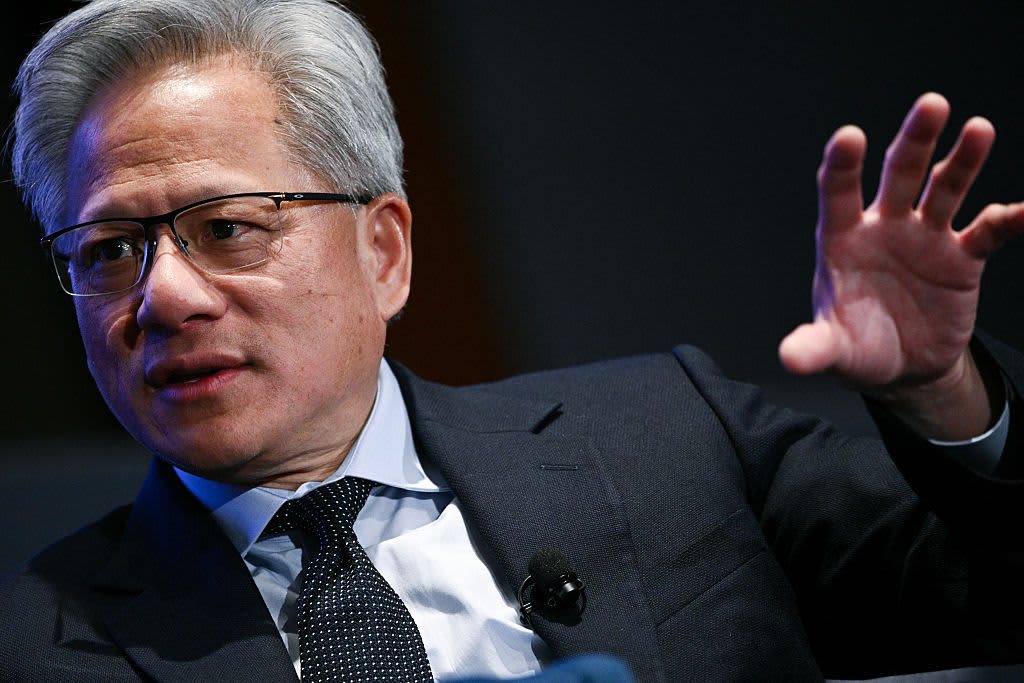

But here’s the kicker: Nvidia, TSMC’s golden child (and AI chip BFF), saw its stock surge 180% this year. Investors are throwing cash at chip stocks like it’s Black Friday, and TSMC’s the store everyone’s rushing into.

Tariff Panic: The Hidden Sales Booster

Now, let’s play detective. Why such a sudden sales spike? Well, besides AI mania, there’s another culprit: U.S. tariff fears. Rumor has it that new trade restrictions could hit, so tech giants like Apple and Nvidia are panic-buying chips like toilet paper in 2020. TSMC’s April sales? A record NT$349.57 billion—partly because everyone’s stockpiling before the potential price hike.

But here’s the plot twist: the Taiwan dollar’s strength could bite into profits. TSMC’s already side-eyeing currency swings, which means even with booming sales, margins aren’t bulletproof.

The Nvidia-TSMC Alliance: AI’s Power Couple

No investigation is complete without examining the ultimate duo: TSMC and Nvidia. Nvidia just pledged to build $500B worth of AI servers in the U.S. over four years—with TSMC’s tech as the backbone. This isn’t just a collab; it’s a strategic power move to dominate AI and appease Uncle Sam’s push for local manufacturing.

But here’s my hot take: while this partnership is a win, it also highlights a risky dependency. If AI demand slows (unlikely, but hey, even tulip mania crashed), TSMC’s throne could wobble.

The Bottom Line: Growth, But at What Cost?

TSMC’s April sales are a neon sign flashing “AI IS KING,” but the company’s not invincible. Currency risks, tariff chaos, and the pressure to keep innovating could turn this gold rush into a high-wire act. Yet, with Nvidia in its corner and AI demand showing no signs of cooling, TSMC’s still the MVP of the chip world—for now.

So, fellow shoppers (or investors), keep your eyes peeled. The semiconductor game is wild, and TSMC’s sales report? Just the first clue in a much bigger mystery.