The Trade War Chronicles: When Tariffs Become the New Currency

Picture this, dude: two economic giants locked in a staring contest, each holding a stack of tariffs like playing cards. Seriously, the U.S.-China trade war isn’t just some dry policy debate—it’s a high-stakes game of economic chicken, and the rest of the world is stuck in the backseat sweating over the GPS rerouting global supply chains. Let’s break down this mess like a detective dusting for fingerprints at a Black Friday riot scene.

—

Round One: Tariffs as the Opening Gambit

The Trump administration kicked things off by slapping tariffs on Chinese imports like a shopper gone rogue with a coupon book—except these “discounts” were 25% *penalties* on everything from steel to sneakers. The accusation? Unfair trade practices and IP theft. But China? Oh, they didn’t just take it. They fired back with tariffs of their own, hitting $20 billion of U.S. goods with 10-15% levies. Classic “eye for an eye,” except the eyes here are made of soybeans and semiconductors.

And let’s talk *style points*: China’s later move to hike tariffs on U.S. imports to 125% was so audacious, even their own officials smirked, calling it a “joke.” Translation: “We can play this game longer than you can afford, buddy.”

—

The Toolkit: More Than Just Tariffs

1. Regulatory Sabotage

China didn’t stop at tariffs—they went full MacGyver, weaponizing export controls on rare earth minerals (aka the “vitamins” of tech manufacturing). No rare earths? No iPhones, no fighter jets. Mic drop.

2. Currency Jiu-Jitsu

Then came the yuan’s “accidental” depreciation. *Oops*, suddenly Chinese exports got cheaper, neutralizing U.S. tariffs. It’s like marking up a thrift-store jacket to “vintage” prices, then slashing it back to $5 during a sidewalk sale.

3. Diplomatic Side-Eye

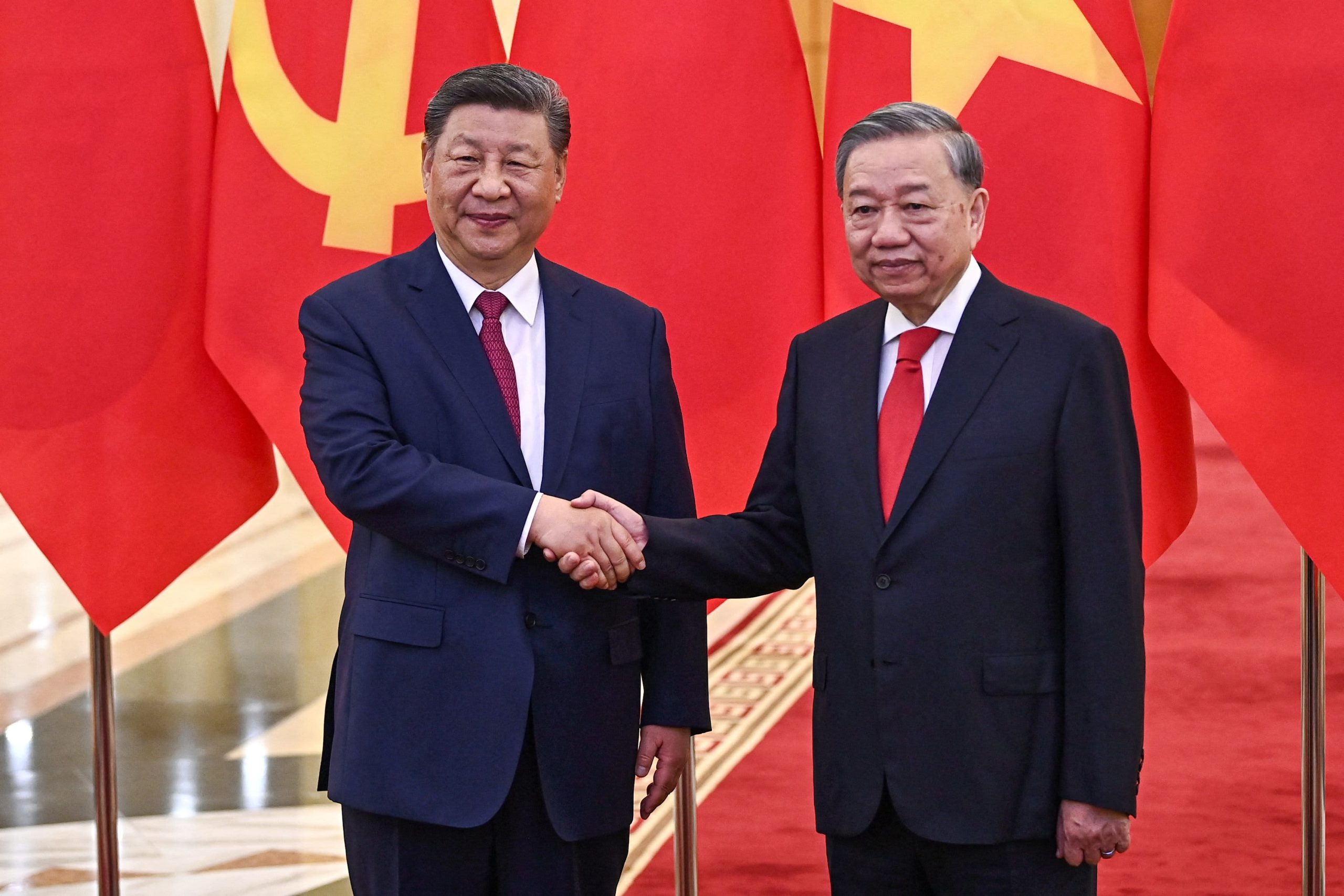

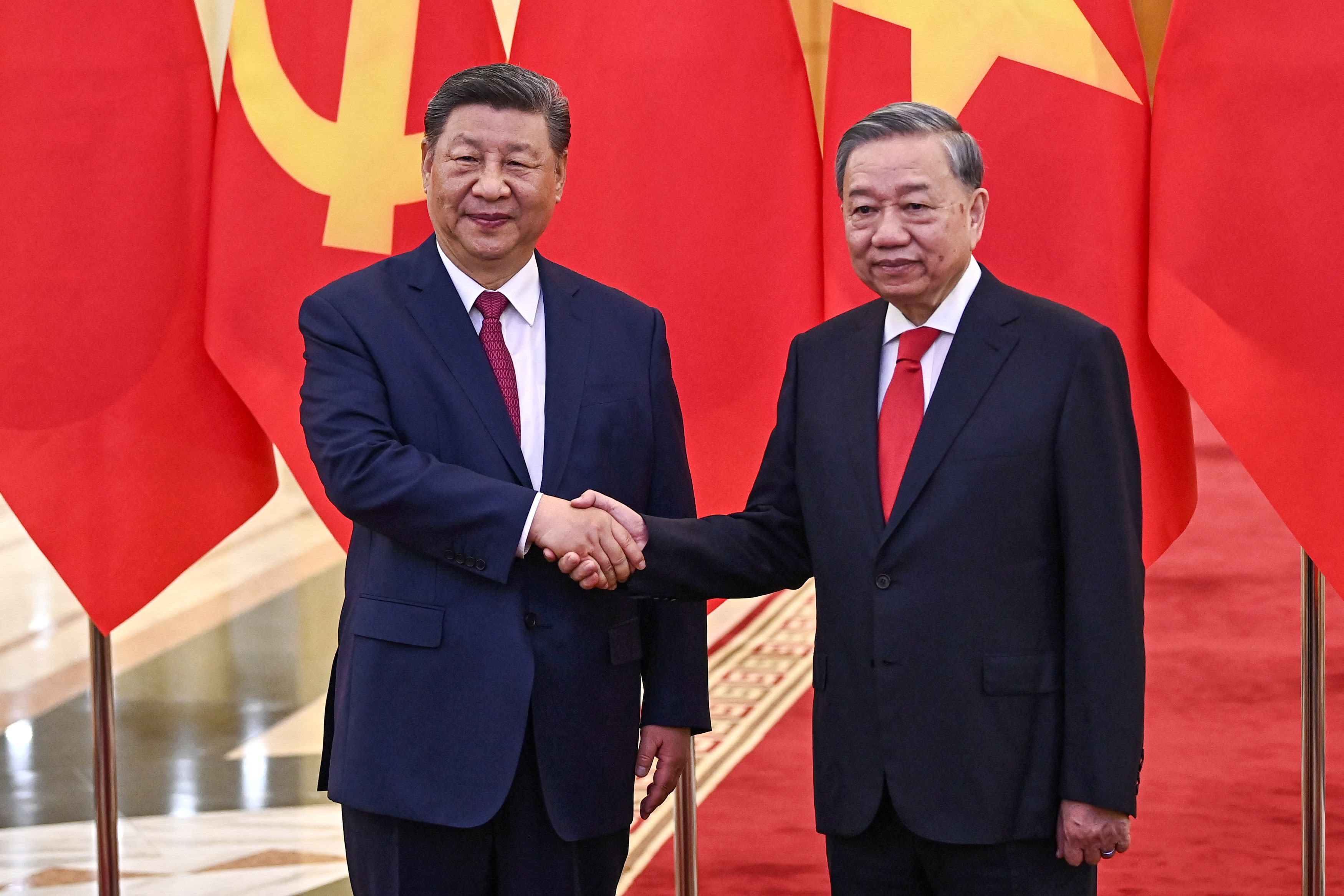

Beijing’s been busy too, whispering to other nations: “Team up with the U.S., and you’re basically investing in Blockbuster.” Xi Jinping’s globe-trotting to forge anti-U.S. trade alliances is the geopolitical equivalent of unfriending someone—then poaching their entire contacts list.

—

Collateral Damage: Who’s Paying the Tab?

Here’s the kicker: this isn’t just a U.S.-China problem. Global supply chains are tangled like last year’s Christmas lights. Example: That “Made in Vietnam” label? Probably Chinese parts assembled there to dodge tariffs. Sneaky? Sure. Genius? Absolutely.

Meanwhile, consumers in both countries foot the bill—whether it’s pricier electronics in Iowa or American lobsters rotting in Shanghai ports (RIP, crustacean diplomats). And let’s not forget the stock markets, swinging like a mood ring at a stress convention.

—

The Plot Twist: Is There an Exit Ramp?

Both sides are *technically* open to talks—with conditions. China demands the U.S. scrap existing tariffs first (like a breakup text: “We can talk if you admit you’re wrong”). The U.S., meanwhile, has eased some consumer tech tariffs—maybe because someone finally noticed voters don’t enjoy paying $1,200 for a microwave.

But the core issues? Still a dumpster fire. Intellectual property disputes, market access, and that pesky trade deficit won’t vanish with a handshake. It’ll take more than diplomacy; it’ll take actual compromise—a concept as rare as a quiet day at a Walmart on Black Friday.

—

The Verdict

This trade war’s revealed two truths:

So here’s the real mystery, friends: Will these giants call a truce, or are we all doomed to a sequel—*Trade War 2: Inflation Boogaloo*? Grab your popcorn (imported, tariff-paid, obviously). The case remains open.